Why Are Some Republicans Voting Again Tax Reform

WASHINGTON — Congress approved a sweeping $1.five trillion taxation bill on Wednesday that slashes rates for corporations, provides new breaks for private businesses and reorganizes the individual revenue enhancement code.

The Senate passed the GOP bill early Wed morning and the House then voted on information technology for a second time to fix technical problems with the legislation, the final step before information technology's sent to President Donald Trump for his signature. No Democrats in either the Firm or Senate backed the measure.

It is the president's first pregnant legislative accomplishment and the biggest tax overhaul in a generation.

Trump, who praised the Republican bill as a "celebrated victory for the American people" at a Cabinet meeting Wednesday, is belongings an issue at the White House in the afternoon with GOP members of the Business firm and Senate to gloat passage, White House Press Secretarial assistant Sarah Huckabee Sanders said. The president is expected to sign the bill at a later on date.

Trump tweeted Wed that the tax cuts are "and then big and so meaningful," adding: "This is a case where the results will speak for themselves, starting very soon. Jobs, Jobs, Jobs!"

The Republican bill was initially canonical on a 227-203 vote in the Business firm Tuesday, with no Democrats supporting information technology. Twelve Republicans also voted against the measure out.

With Vice President Mike Pence presiding and Treasury Secretary Steve Mnuchin on hand, the Senate then voted 51-48 in favor of the bill. Again, with no Democratic back up.

"Afterwards 8 directly years of tiresome growth and underperformance, America is ready to have off," Senate Majority Leader Mitch McConnell said post-obit the vote.

The bill, the product of negotiations between Republicans in the Firm and Senate, achieves longtime Republican goals, including a permanent reduction in the corporate tax charge per unit to 21 percent from 35 percent that supporters debate will make American business concern more competitive overseas.

Many pass-through businesses also receive a more complicated 20 pct deduction, which became a field of study of fierce debate after the final pecker added a provision likely to benefit existent estate companies like Trump's.

Business firm Speaker Paul Ryan, R-Wis., lauded the bill during an interview with NBC's "Today" on Midweek forenoon, reiterating the GOP's claim that cut the corporate revenue enhancement rate would allow American companies to create new jobs with the savings and rejecting criticism that companies would merely pocket the savings.

"It's not a question of if, it'southward a question of how much they do good," he said.

The nib will "put the American economy in a better position," Ryan said, because "workers benefit, wages go up."

"This is a big tax cut for families every bit well," he said.

A 24-hour interval earlier, speaking on the Firm floor moments before the vote, Ryan said the legislation volition "assist hard-working Americans who have been left behind for also long."

"Today, we are giving the people their money dorsum," he said, calculation that a typical family would get a $ii,059 tax cut next yr.

Democrats opposed bill as a benefaction to the wealthy while offer little for the heart class, with Firm Minority Leader Nancy Pelosi, D-Calif., calling information technology "the worst bill to always come to the floor of the Firm."

There were a number of protesters in Congress on Tuesday, on both the Firm and Senate sides. Protesters interrupted the Senate's final late night vote numerous times, at one signal shouting, "Kill the bill. Don't kill us." One protester interrupted Ryan in the House when he was speaking.

The GOP bill lowers individual tax rates, including the top bracket to 37 percent from 39.6, while doubling the standard deduction and replacing personal exemptions with a $2,000 partly refundable kid tax credit. Information technology eliminates various deductions while limiting others on state and local taxes and mortgage interest. It also exempts larger inheritances from the estate tax, doubling the thresholds to $eleven million for individuals and $22 million for married couples.

The bill likewise has meaning implications for health intendance, where it abolishes the Affordable Care Act'south punishment for Americans who don't purchase insurance. The Congressional Budget Part estimates that change would lead thirteen million more Americans to go without coverage after a decade and cause premiums on the individual market to rise 10 pct per year.

On Tuesday, Sanders besides defended claims by the president — which tax experts say are likely wrong — that his own taxes would go upward under the legislation, saying the pecker "certainly, on the personal side, could cost the president a lot of money."

While Trump has bucked tradition past refusing to release his tax returns, he is likely to benefit from cuts to the top income tax charge per unit and especially from a new xx percent deduction for pass-through businesses that'south favorable to commercial real estate companies. His family would likewise benefit from the bill'south changes to the manor tax.

"Aye, the president will benefit from that (laissez passer-through cut), but so many Americans benefit when commercial real manor becomes easier and more than accessible," Rep. Matt Gaetz, R-Fla., told MSNBC on Tuesday.

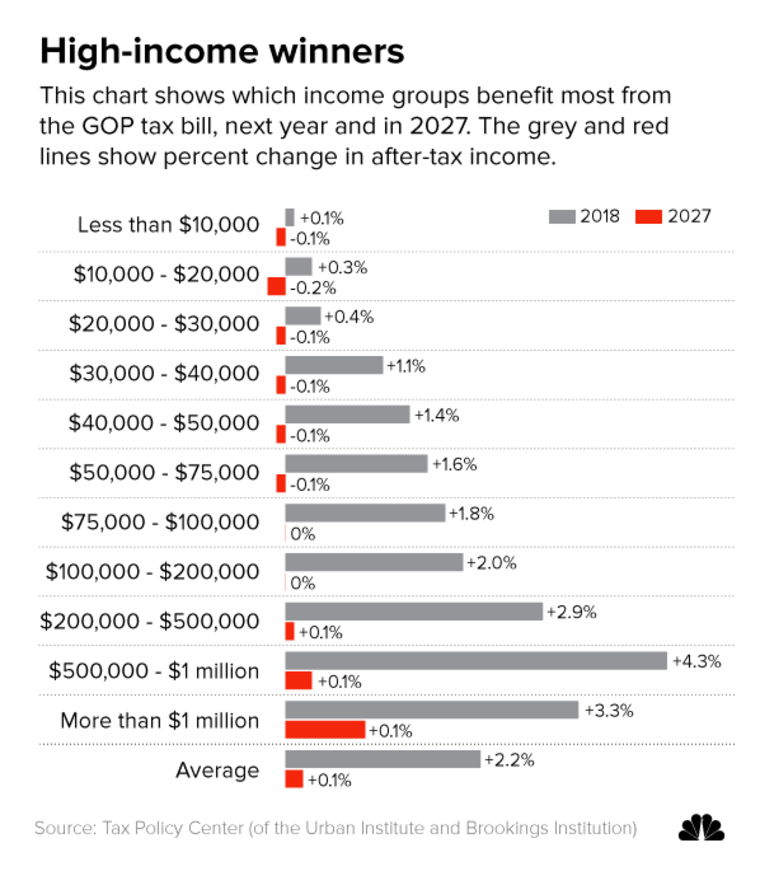

The ultra-rich fare well in the tax bill overall. An assay by the nonpartisan Taxation Policy Center plant that 83 pct of households in the summit 0.one percent would receive a tax break in 2022 with an average benefit of $193,380. For the centre 20 per centum of earners, the average tax cut would be $930. Over half the bill'due south total benefits would go to the summit 10 percent of earners.

While Republicans are enthusiastic about their efforts, the legislation is intensely unpopular with the American public, with numerous surveys showing voters skeptical they'll gain from its temporary cuts to individual rates in comparing to shareholders, business owners and the wealthy.

An NBC/Wall Street Journal poll released on Tuesday found 24 percent of respondents back up the beak, versus 41 percent opposed. And 63 percentage say it was designed primarily to do good corporations and the rich, versus 22 percent who say it's aimed at all Americans equally, and just seven percent who say it'southward for the middle form.

Separate polls by Quinnipiac, Marist and Monmouth this calendar month found support for GOP tax efforts in the mid-20s, with other surveys placing information technology somewhat higher.

"Republicans volition rue the 24-hour interval that they pass this tax bill because it's and so unfair to the middle class," Senate Minority Leader Chuck Schumer, D-North.Y., said Tuesday. "Information technology then blows a hole in our arrears, it so threatens Social Security, Medicare and Medicaid. They volition rue the day."

Republican lawmakers argue that voters will come around to the legislation as members tout its benefits at home and taxpayers see gains in their own returns and in the broader economy. Trump boasted in a tweet on Tuesday that the stock market had risen in contempo months.

"I don't think nosotros've done a practiced chore messaging," Rep. Greg Walden, R-Ore., told reporters. "I don't think nosotros've gotten out there the specifics and the last bill has but come together in the final week or and then."

The White House director of legislative affairs, Marc Curt, said Americans' opinion of the GOP tax plan would amend in the months ahead.

"I call back that is going to change, we volition run across one time the economy continues to roar and people begin to encounter more coming in their paycheck," Brusque said Tuesday on MSNBC.

The Articulation Committee on Revenue enhancement, the official congressional scorekeeper, estimates every income group would receive an average tax cutting next year. Only the JCT likewise constitute taxes would get upwards for lower incomes over fourth dimension, in part because fewer eligible taxpayers would choose to receive health care subsidies through the ACA. By 2027, every income group making less than $75,000 would meet a net tax increment.

The nonpartisan Tax Policy Center, which did not factor in the health intendance changes, estimated that lxxx per centum of taxpayers would meet a taxation cutting in 2022 and four.eight percent come across a tax increase, with many low-income households seeing little change either way. Simply the portion of taxpayers facing a tax increase would rise to 53.4 percent in 2027, when the bill's temporary taxation breaks elapse. Republicans argue time to come Congresses will extend those breaks.

pattersonmaint1997.blogspot.com

Source: https://www.nbcnews.com/politics/congress/republican-tax-bill-house-senate-trump-n831161

0 Response to "Why Are Some Republicans Voting Again Tax Reform"

Post a Comment